Other than Harvard University, The Ford Foundation is the second largest private foundation in the United States, with an endowment of over $10 billion.

Harvard’s endowment, the University’s largest financial asset, is a perpetual source of support for the University and its mission of teaching and research. The endowment is made up of more than 13,000 funds; the two largest categories of funds support faculty and students, including professorships and financial aid for undergraduates, graduate fellowships, and student life and activities.

What is Harvard’s endowment?

Harvard’s endowment is a dedicated and permanent source of funding that maintains the teaching and research mission of the University. Made up of more than 13,000 individual funds invested as a single entity, the endowment’s returns have enabled leading financial aid programs, groundbreaking discoveries in scientific research, and hundreds of professorships across a wide range of academic fields.

Each year, a portion of the endowment is paid out as an annual distribution to support the University’s budget, while any appreciation in excess of this annual distribution is retained in the endowment so it can grow and support future generations. As a result, the endowment can provide the financial foundation for the University for generations to come.

Distributions from Harvard’s endowment provide a critical source of funding for the University. The endowment distributed $1.7 billion in the fiscal year ending June 30, 2016—contributing over a third of Harvard’s total operating revenue in that year. The overwhelming majority of the funds that make up Harvard’s endowment are restricted to specific programs, departments, or purposes (dedicated scholarships, named professorships, etc.), and must be spent in accordance with terms set forth by the donor. Payout from these funds can only be spent in support of the fund’s designated purpose. Unrestricted funds, which account for about 30 percent of Harvard’s endowment, are more flexible in nature and are critical in supporting structural operating expenses and transformative, strategic initiatives.

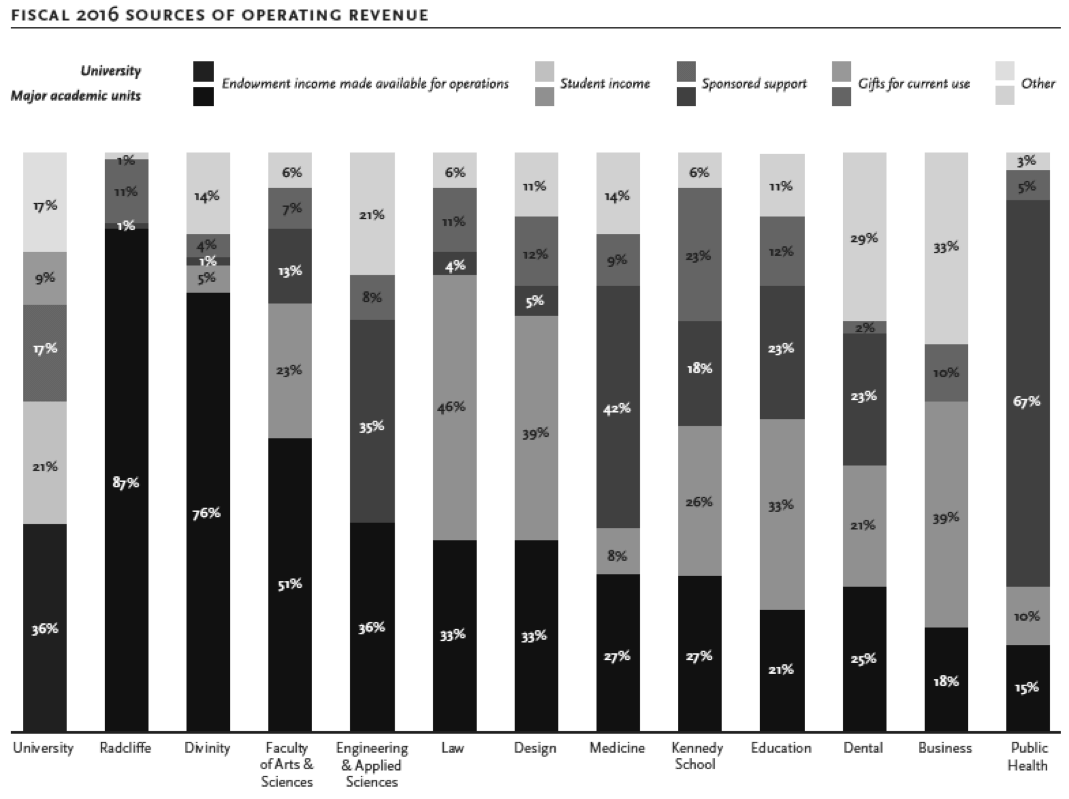

Each of Harvard’s twelve Schools “owns” its share of the endowment. Roughly 80 percent of the funds that make up the endowment are dedicated by the donor to a specific School. School revenue profiles vary widely, and each draws a different proportion of its budget from its endowment.

What does Harvard’s endowment support?

The endowment remains the largest source of revenue supporting the University budget. In fiscal year 2016, endowment distributions for operations represented 36 percent of the University’s income—ranging from 87 percent of Radcliffe Institute for Advanced Study revenue down to 15 percent for the Harvard T.H. Chan School of Public Health.

Endowment funds support nearly every aspect of University operations. The two largest categories of funds cover faculty salaries, including professorships, and financial aid for undergrads, graduate fellowships, and student life and activities. Harvard also has endowments that support academic programs, libraries, art museums, facilities, and a wide variety of other activities.

Even with endowment support, Harvard must fund nearly two-thirds of its operating expenses ($4.7 billion in fiscal year 2016) from other sources, such as federal and non-federal research grants, student tuition and fees, and gifts from alumni, parents, and friends.

Who manages Harvard’s endowment?

Formed in 1974, Harvard Management Company (HMC)—a nonprofit, wholly owned subsidiary of Harvard University—manages the endowment. HMC’s singular mission is to support the University by investing and enhancing its financial resources for the long term.

Under HMC’s “hybrid model” of investing, Harvard’s endowment funds are managed through internal investment professionals, as well as through relationships with third-party managers. This allows HMC to combine top-quality investment management by internal teams with cutting-edge capability from specialized teams around the world. The benefits of this approach include the alignment of interests, cost efficiency, and greater transparency.

How does Harvard determine its endowment payout?

The University’s spending practice has to balance two competing goals: the need to fund the operating budget with a stable and predictable distribution, and the obligation to maintain the long-term value of endowment assets after accounting for inflation.

The University determines the annual endowment distribution by utilizing a payout formula that provides a steady stream of income to support current needs while preserving the endowment’s future purchasing power. This process is similar to those of many other colleges and universities.

Harvard targets an annual endowment payout rate of 5.0 to 5.5 percent of market value. The University’s actual payout rate has fluctuated over the past 10 years, from a low of 4.2 percent in fiscal year 2006 to a high of 6.1 percent in fiscal year 2010. This variation exists because the dollar amount of the distribution for the next fiscal year is determined well in advance of the start of the fiscal year and prior to knowing the market value at the end of it. This practice is followed to allow Schools and units adequate time for financial planning.

The utilization of this payout formula means that the annual payout rate is generally lower following years of relatively high investment returns and higher following years of lower investment returns. Adjustments are made in succeeding years, keeping in mind the long-term payout goal. The Harvard Corporation approves the final distribution amount. Because the endowment is managed as a single investment pool by HMC, the annual payout rate is consistent across all funds.

Why can’t Harvard use more of its endowment in order to cover additional expenses or reduce tuition costs?

Returns from the endowment foster leading financial aid programs, scientific research discoveries, and hundreds of professorships.

However, there is a common misconception that endowments, including Harvard’s, can be accessed like bank accounts, used for anything at any time as long as funds are available. In reality, Harvard’s flexibility in spending from the endowment is limited by the fact that it must be maintained in perpetuity and that it is largely restricted.

Endowment gifts are intended by their donors to benefit both current and future generations of students and scholars. As a result, Harvard is obligated to preserve the purchasing power of these gifts by spending only a small fraction of their value each year. Spending significantly more than that over time, for whatever reason, would privilege the present over the future in a manner inconsistent with an endowment’s fundamental purpose of maintaining intergenerational equity.

In addition, many donors also designate a specific purpose for which their fund can be spent. For Harvard, roughly 80 percent of endowed funds are subject to these restrictions. Contributions may be given in support of a specific School, program, or activity, and can only be used for those purposes.

Press releases about the endowment’s performance can be found below:

In addition, a 2012 Q-and-A with Jane Mendillo, former president and CEO of Harvard Management Company, can be found here.